Exploring the Solutions Provided by a Home Loan Broker for First-Time Purchasers

:max_bytes(150000):strip_icc()/GettyImages-1371116740-505095f35b944dfa836a423691b9bc30.jpg)

Recognizing Home Loan Kinds

When starting the trip of homeownership, understanding the various sorts of home mortgages is essential for first-time customers. Home loans are financial tools that enable individuals to borrow funds to purchase a home, and they come in several kinds, each with distinct functions and benefits.

The most common kind is the fixed-rate home loan, which provides a steady rate of interest throughout the loan term, normally varying from 15 to three decades. This predictability makes budgeting less complicated for home owners. Alternatively, adjustable-rate mortgages (ARMs) feature fluctuating interest prices that can transform after a preliminary set period, potentially leading to reduced preliminary payments but increased threat with time.

Another alternative is the government-backed finance, such as FHA, VA, or USDA finances, which satisfy particular buyer demands and commonly require reduced deposits and credit report. For customers looking for versatility, interest-only home mortgages permit lower first repayments, though they might result in bigger repayments later on.

Recognizing these home loan kinds equips first-time customers to make educated choices that align with their financial goals and long-lasting strategies. Engaging with a home loan broker can give important insights customized to individual scenarios, better simplifying the decision-making process.

Assessing Financial Scenarios

Assessing monetary scenarios is a crucial action for first-time property buyers, as it lays the structure for determining affordability and appropriate mortgage options. An extensive analysis includes analyzing revenue, expenses, credit report, and cost savings, which collectively shape the purchaser's monetary profile.

Credit rating play a considerable function in home loan qualification and rate of interest; thus, newbie buyers must acquire and review their credit scores records. When applying for a financing., determining any kind of discrepancies or locations for enhancement can improve their economic standing.

Additionally, examining savings is important, as it establishes the dimension of the deposit and can influence home mortgage terms (mortgage broker san Francisco). Buyers ought to intend to have a minimum of 3% to 20% of the home rate saved for the down repayment, in addition to additional funds for closing prices and reserves. A comprehensive evaluation of these components will equip new buyers to make informed decisions in their homebuying journey

Navigating the Application Refine

Browsing the application procedure can be a daunting experience for novice property buyers, as it entails a series of crucial steps that need to be finished properly and successfully. Mortgage brokers play a critical function in simplifying this journey, offering important assistance and guidance throughout.

Initially, the broker will help gather essential paperwork, including income verification, work history, and credit score records. Making certain that all paperwork is organized and accurate is important, as any discrepancies can lead to delays or rejections. The broker additionally aids in finishing the home loan application itself, guaranteeing that all needed fields are filled in appropriately.

As soon as the application is submitted, the broker serves as a liaison in between the customer and the loan provider, maintaining the lines of interaction open. They proactively deal with any inquiries or worries raised by the lending institution, which can accelerate the approval procedure. Furthermore, brokers commonly offer understandings into potential backups or conditions that might occur during underwriting.

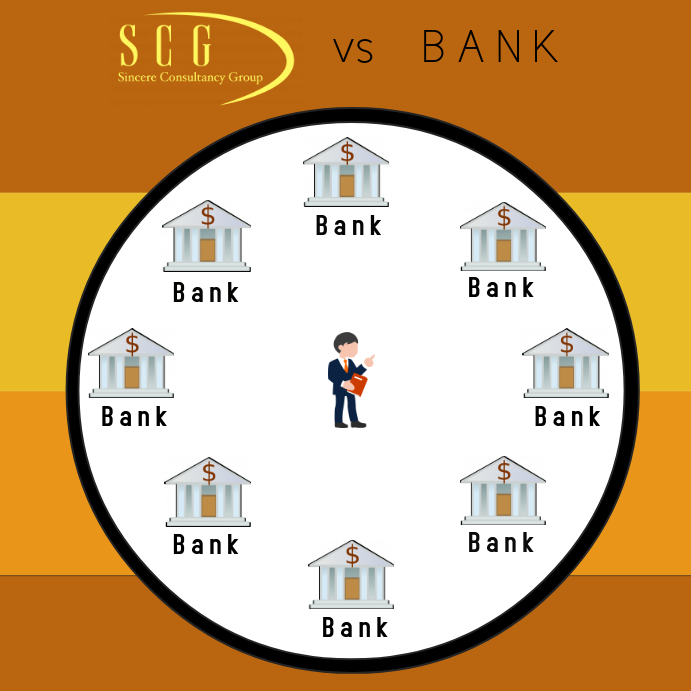

Contrasting Lending Institution Options

After completing the application procedure, new homebuyers need to review numerous lender choices to safeguard one of the most beneficial home loan terms. This vital step includes contrasting passion rates, funding kinds, and settlement options provided by different loan providers. Each lending institution might offer distinct advantages, such as lower closing expenses, versatile payment timetables, or specialized programs for newbie buyers.

Rate of interest rates play an essential duty in establishing the overall expense of the home loan. Debtors must think about whether a taken care of or Read Full Report variable price is a lot more useful for their economic scenario. Dealt with prices supply security, while variable prices may supply lower initial payments but featured possible variations.

Furthermore, it is important to examine loan provider track records - mortgage broker san Francisco. Investigating customer reviews and rankings can supply insight into their solution top quality and responsiveness. Moreover, first-time purchasers ought to ask about any readily available aid programs that specific loan providers could use, which can relieve the financial worry of buying a home.

Eventually, a comprehensive contrast of lender alternatives encourages novice buyers to make educated choices, ensuring they choose a mortgage that straightens with their long-lasting economic check my reference goals and homeownership ambitions.

Providing Ongoing Assistance

Guaranteeing first-time property buyers really feel supported throughout their home loan trip is vital for cultivating self-confidence and contentment. A mortgage broker plays a pivotal duty in this process by providing continuous aid that extends beyond the first lending approval. From the minute customers share interest in buying a home, brokers are readily available to address questions, make clear terms, and address worries that might arise during link the transaction.

Brokers likewise maintain customers educated concerning the various stages of the home mortgage procedure, ensuring they understand what to expect and when. This proactive communication assists alleviate stress and anxiety and enables purchasers to make educated choices. Brokers can help in navigating any type of difficulties that may emerge, such as issues with documentation or changes in economic conditions.

Post-closing assistance is just as vital. An experienced broker will certainly adhere to up with customers to guarantee they are pleased with their home loan terms and offer assistance on future refinancing options or adjustments essential for economic stability. By maintaining an open line of communication and offering expert recommendations, mortgage brokers encourage newbie purchasers, helping them really feel safe throughout their entire homeownership trip.

Verdict

In recap, mortgage brokers play an essential role in promoting the home-buying procedure for newbie buyers. Their knowledge in understanding numerous home loan kinds, analyzing monetary situations, and browsing the application process boosts the general experience. By contrasting lender options and providing continuous assistance, brokers encourage clients to make enlightened decisions. This thorough support ultimately fosters self-confidence in achieving homeownership, emphasizing the value of expert guidance in what can be an overwhelming trip.

Home mortgage brokers serve as essential allies in this complex landscape, giving an array of services tailored to relieve the worries of getting a mortgage. mortgage broker san Francisco. A home loan broker plays a crucial duty in this process by offering recurring support that prolongs past the preliminary loan approval. A proficient broker will certainly follow up with clients to ensure they are satisfied with their mortgage terms and offer support on future refinancing options or modifications needed for monetary security. By preserving an open line of communication and offering professional suggestions, home mortgage brokers encourage new customers, aiding them really feel safe and secure throughout their whole homeownership trip

In recap, home mortgage brokers play a critical duty in promoting the home-buying procedure for newbie customers.